In contrast, FreshBooks has a robust online resource library and a basic troubleshooting chatbot. You can request help directly from your FreshBooks dashboard, which includes quick links to the FreshBooks help center. Additionally, Wave Payroll’s full-service plan, which calculates and remits payroll taxes on your behalf, is limited to 14 states. Clients in all other states must use Wave Payroll’s self-service plan, which costs less but requires you to file payroll taxes on your own. We believe everyone should be able to make financial decisions with confidence. Although both programs have robust revenue and expense tracking capabilities, FreshBooks has a tiny advantage.

QuickBooks Online is a more scalable option than FreshBooks or Wave, with four plan tiers and the flexibility to support larger, smaller companies. The software includes a variety of features and add-ons, as well as integration with hundreds of apps, including QuickBooks’ own payroll and payment processing software. If you’re a service-based business or an independent contractor who’s always out in the field, having the ability to record hours worked and assign them to your customers is very convenient. However, both Wave and FreshBooks don’t allow you to enter bill payments, classify transactions from bank feeds, and view reports. If you need such features, you might want to check out Zoho Books, which tops our list of the best mobile accounting apps. Both FreshBooks and Wave are good at invoicing, but FreshBooks provides more customization options.

QuickBooks’ customization options are more elaborate than FreshBooks, but are also designed for larger companies and businesses that need more flexibility in their accounting systems. The Plus and Premium plans are $7.50 and $13.75 per month, respectively, during the same time frame. This is ample time to see if the platform meets your business needs and will perform the functions you desire. If you want multiple eyes on your accounts without paying extra, Xero has unlimited users. Zoho Books charges just $3 per month per extra user, and QuickBooks Online offers access for up to 25 users (depending on which plan you choose). Three of FreshBooks’ four plans include access for just one user in the base cost.

FreshBooks Is Built to Support Growing Businesses—and Their Clients

In the Reports tab, you can access popular business accounting reports such as profit and loss, sales tax summary, aging accounts, invoice details and expense reports. Looking at these reports helps a business owner better understand their company’s financial health and is critical in the daily management of the organization. FreshBooks offers you time tracking, expense tracking, payments, reports and so much more.

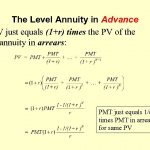

(The enterprise-level accounting plan includes two users in the base cost.) While you can add as many users as you want, you’ll pay an how to find the present value of your annuity extra monthly fee of $11 per person — a cost that can add up fast. By way of comparison, Wave Accounting, Xero, QuickBooks Online and most other accounting software services automatically default to double-entry accounting. All of these competitors include accountant access with every plan, even plans that otherwise limit you to one user only. NerdWallet’s accounting software ratings favor products that are easy to use, reasonably priced, have a robust feature set and can grow with your business.

Businesses can also take advantage of a 10% discount if they pay annually rather than month to month. Support for non-paying users is limited to the chatbot and self-service Help Center. Only integrates with in-house apps, like Wave Payments and Wave Payroll; does not integrate with card readers for in-person payments. FreshBooks integrates with hundreds of third-party applications to automate various business operations that are beyond its capabilities.

- FreshBooks is a good option for those who don’t have a lot of experience in accounting and want an easy-to-use way to manage their business finances.

- This helps you from falling behind on entries when working away from your desk.

- Our software rankings are based on our unique, in-depth research categories, including software attributes, pricing factors, support, and more.

- Zoho Books has a variety of capabilities, such as automated workflows and real-time project tracking.

- As mentioned earlier, FreshBooks has more features than Wave, which is somehow expected given that Wave used to be free and is focused on very small businesses with basic accounting needs.

Feature comparison: FreshBooks vs. Wave Accounting

So it will be up to the business owners to determine which limit will be more detrimental to business needs. This means that you can access the platform from anywhere avoidable cost as long as you have an internet connection. Whether you use the desktop software or the mobile app, you can detail expenses, send invoices and run reports. Have the reports that you need at your fingertips all the time with FreshBooks.

Vencru: The Invoicing and Accounting Software for All Businesses

The safety of your private data is our top priority, that’s why it’s protected by 256-bit SSL encryption—the gold standard in Internet security. FreshBooks is cloud based accounting software and uses industry–leading secure servers. When growing businesses feel it’s time to upgrade from invoicing only, they choose FreshBooks to manage their books and deliver better results to their clients. While you should always take your business’s unique needs into account when choosing an accounting software provider, we recommend following these general guidelines.

Online Payments

Zoho Books provides a range of features including automated workflows and real-time project tracking. Its highest tier plan caps users at 15, but you can add more for an additional monthly fee. Zoho has a suite of accompanying software that integrates with its accounting program, including customer relationship management, sales and marketing tools. Zoho Books has a variety of capabilities, such as automated workflows and real-time project tracking. Its most expensive plan limits users to 15, but you can add more for an additional monthly cost. Zoho features a suite of accompanying software that connects with its accounting program, revenue definition including customer relationship management, sales, and marketing tools.